Green Investing

Mindset of Change

I Didn't Just Come Here to Dance by Carly Rae Jepsen

One of the reasons taking climate action feels so hard for us as individuals is that the systems we live in weren't developed with the environment in mind. That is to say, the world's systems – of food and energy production, transportation, goods and services – do not prioritize climate or environment.

- By and large, food systems optimize for cheap variety on demand. They do not prioritize nutrition, soil health, biodiversity, or retaining land for pollinators and wild creatures.

- Energy companies optimize for cheap energy on demand. They largely do not have to consider the cost of pollution or carbon emissions.

- Transportation companies - primarily car and road companies in the US, as well as airlines, but also trains - have been built around petroleum as the main fuel source.

- For most goods and services, the priority is cheap variety on demand, and environmental costs of production or disposal are not considered.

In general, as a society we have optimized for cheap and convenient. Companies are, of course, the tip of the spear here, but individuals do share some responsibility. Companies produce what we buy, and although they definitely hide information and mislead consumers (hello, greenwashing!), ultimately if we didn't buy their products, they would stop making them.

So why do we buy this stuff and opt into these systems? Well, in some cases, its really hard to do otherwise. (Information is not available or hidden, we don't have enough time to think about it, or the real tradeoffs are still not clear). But in some cases, its impossible not to. We need to eat, and get to work and school. We need to see our families and friends and occasionally the world. We need clothes and shoes and bookshelves and computers. And as it turns out, living alone in the woods off-grid is actually not all that sustainable either (unsustainablemagazine.com)!

For individuals, living susty must be two-pronged:

- We must make the best choices we can under the current systemic conditions.

- We must try to change the system.

In this, we are lucky. Because we live in a capitalist society, #1 actually supports #2. Not as clearly or directly as we might like (its not a totally free market after all), but nonetheless, when a large percentage of "consumers" (as the economists love to call us) all shift our behavior, the market will eventually react.

Change your investment profile.

Financing Climate Solutions

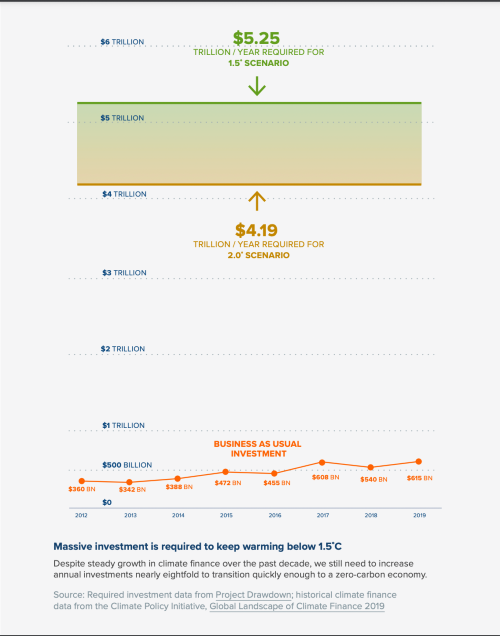

"Finance is critical to avoiding a climate crisis: the world needs to mobilize US$4–5 trillion annually to keep atmospheric warming below 2°C—eight times what we’re currently spending" (projectdrawdown.org). As we might expect, changing the system is expensive. Building solar projects and wind turbines, doing research on better battery technology, building EVs and high speed rail, figuring out how to do vertical farming in a warming climate, developing biofuel planes, researching a way to make environmentally-friendly jeans...it all takes money.

In most of the world, the money to finance building things and innovating comes from investments. In fact, that is what investing is - we invest in building some future state of the world. Now, I would call out two different approaches to investing:

- Investing to make money

- Investing to create value (and make money)

When the market is 'bubbly' and stocks are 'over-valued,' it's generally because people are investing with the goal of making money. They are trying to game the system. Instead of investing in something that they think is really valuable, they invest because they think the stock will go up. This is contrary to what most great investors do. Warren Buffett once said: “Buy into a company because you want to own it, not because you want the stock to go up.”

Now, before I go further, here is my requisite disclaimer: I am not a financial advisor and you should certainly consult one.

Imagine two futures.

In one future, the world has successfully adapted to climate change. We have changed our systems, curbed our emissions, arrived at a new standard of living that allows humans and nature to coexist. Possibly this future has lots of high speed rail, very few cars, biodiverse pollinator-rich vertical farms, roofs covered in solar panels, clean water ways, lots of trees and parks, healthy ecosystems. People have less stuff and are more self sufficient. We walk and bike more and health care becomes less expensive. We lost a lot of species, but some are coming back. Heck, maybe we saved the orangutan.

In another future, we have not successfully adapted to climate change. Fossil fuels are still the primary fuel source, but we've exhausted the natural gas deposits and OPEC is setting extravagant prices per barrel. Alternate droughts and flooding have caused hoards of climate refugees to overwhelm more developed countries, whose healthcare and support systems are struggling. Inequality has increased even more. The super rich now have bodyguards and are shuttled from their island to walled luxury home. Most normal people are struggling.

Now, I am not describing these scenarios to promote fear mongering. I am describing them to set the context for a question: which future do you want to invest in?

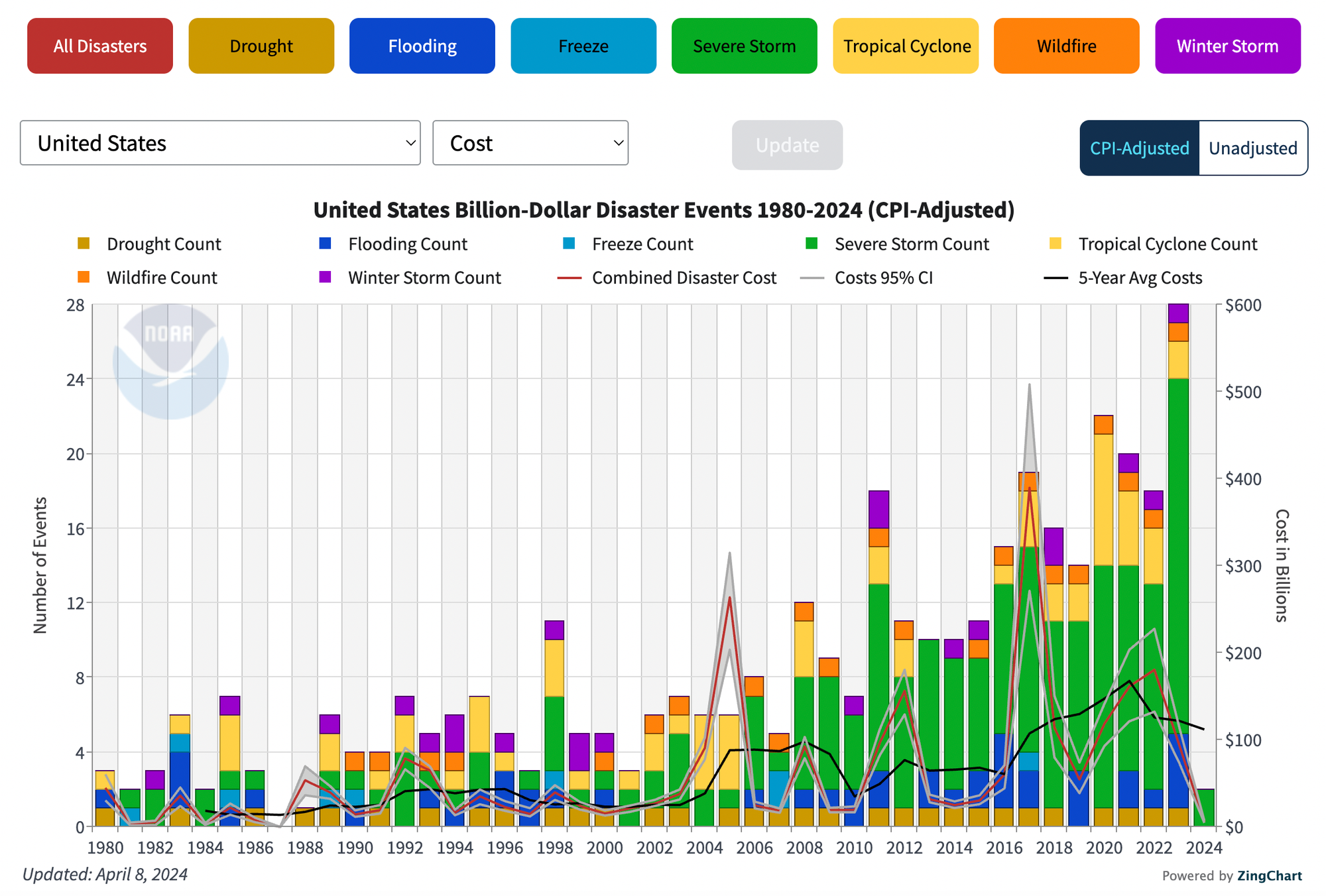

Maybe this seems like an unfair question with a biased setup. But actually, these are less drastic than what could be. Although the science is less clear about the timeline (how soon is "the future?"), the effects of climate change are not in dispute. We've already started to experience them.

Money Talk

Now that you've decided what future you would prefer to support (and I am going to assume you decided on the climate happy future, since you're still here), let's talk money. In order to reach this happy version of the future, some companies are going to have to innovate and become very successful. Solar panel and wind turbine companies, EV and rail companies, biofuel companies, battery tech companies, alternative meat companies, sustainable farming companies. When these companies become successful, they are going to make their investors money. New companies, new sectors, new opportunities to get in on the ground floor.

Let's talk actual ROI.

I highly recommend that you read this introduction to sustainable climate investing by Carbon Collective. It will probably take you around 30 min so feel free to read it after this. I will give you a little preview. (Full Disclaimer: they handle my portfolios.)

There are different levels of climate investing, and different levels of risk. You can invest in companies that are mostly climate neutral (e.g. Apple, CocaCola) or climate-solution companies (e.g. Beyond Meat, Rivian). You can also invest in more stable offerings (like Green Bonds, or climate-neutral S&P 500 companies) or in more risky companies (like Tesla, Beyond Meat).

While investing in renewable energy is likely lower risk (especially in the long term), investing in EVs may be higher risk (as we've seen with Tesla). Investing in new battery technologies is even riskier (one of them will probably win, but which one?). One of the main things I like about Carbon Collective is that they balance all of these considerations and offer different blends suitable for different climate and risk profiles.

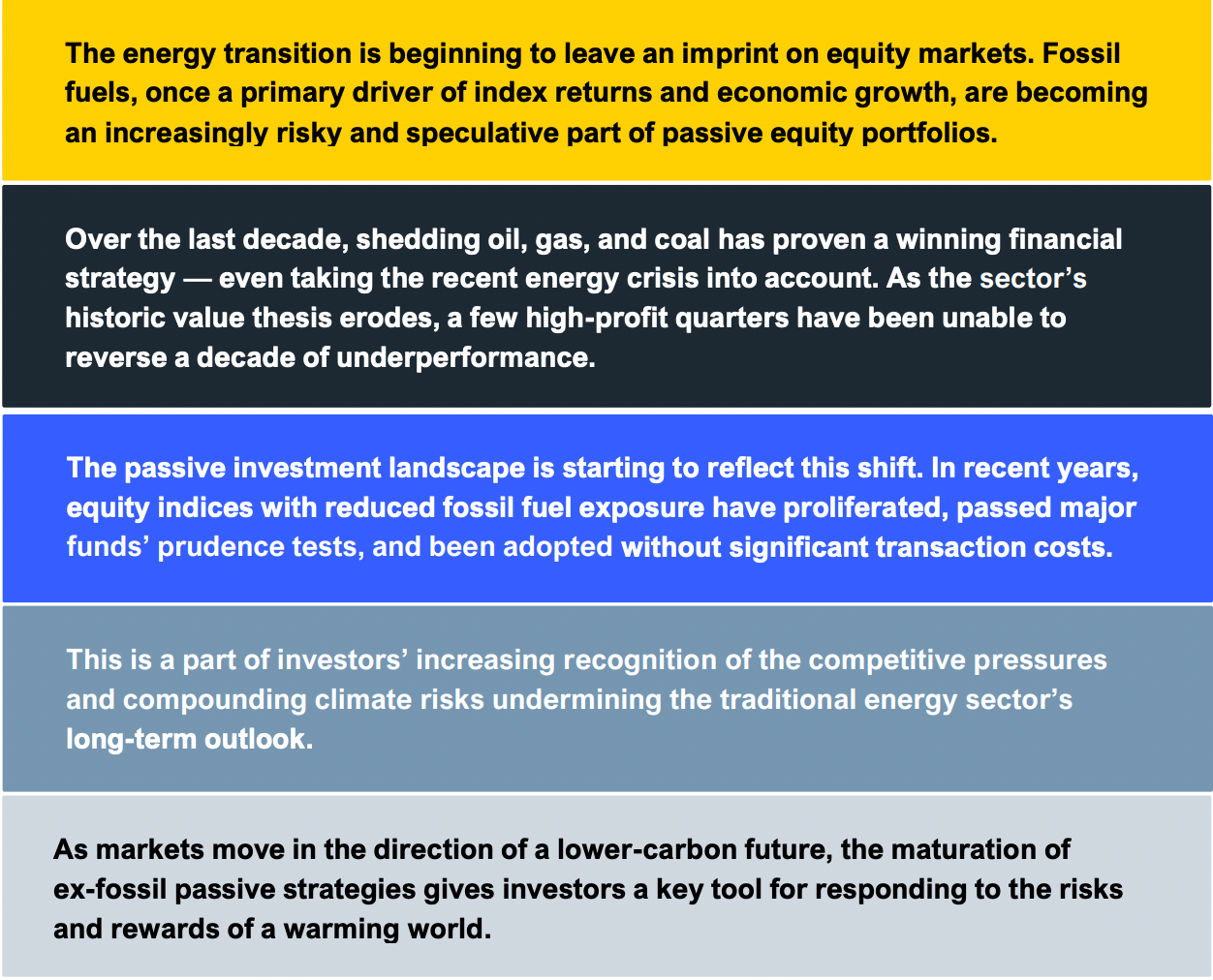

However, one thing has become pretty clear: fossil fuels are no longer a very good investment. Although they've seen a couple high quarters due to high oil prices, historically they have underperformed and they are becoming increasingly risky as climate policies become more imminent. Portfolios that have shed fossil fuel stocks have actually performed better than those which have not (nytimes.com).

So what does this mean? Well, lucky for us, it means that we don't have to make a super hard tradeoff. We can invest for value and for return. The only real difficulty is that, although climate investing is becoming easier, its still not the status quo. That means your standard investment advisor may not be super familiar with it.

How to change your portfolio

I'm going to assume you are at one of three levels in terms of managing your investments:

- You have an investment advisor who does it for you.

- You have an investment advisor who keeps most of your money, but you have a trading account on the side.

- You actively manage most of your investments.

Level 1

You have two choices.

First option: you can switch your investment advisor to one that specializes in sustainable investment, a company like Carbon Collective, Betterment. For a decent list, see here.

Second option: you can draft an email to your investment advisor (feel free to link this post if you like) and tell them you want to divest from fossil fuels and invest more in climate solutions. You can send them this link a database of fossil fuel free funds: https://fossilfreefunds.org/

Level 2

You have the same options as Level 1, plus you can look at the Fossil Free Funds database yourself. I advise you start here.

Level 3

If you're still here, I assume you're pretty pro-climate. You're also probably still pretty skeptical. Understandable. I highly recommend you go read that Sustainable Investing primer from Carbon Collective I linked above. Regardless of whether you like their investment approach, it provides a good basis for thinking about the tradeoffs. If that is not enough for you, here is McKinsey on the topic.

Once you're ready to actually look at funds, I advise you start here. Beware of greenwashing. For example, several of the "climate" funds that Morningstar advocates for receive poor ratings on Fossil Free Funds.

Investing is hard, and nothing is guaranteed. Yet, as always, something is better than nothing when it comes to climate action. Do what you can, and happy investing!

And for some inspiration: