Green Banking

Mindset of Change

Big Yellow Taxi - Joni Mitchell

The importance of money flows from it being a link between the present and the future.

John Maynard Keynes

It is an unfortunate truth that, if you have never tried to avoid funding fossil fuels, you almost certainly are. "When you drop money in the bank, it looks like it’s just sitting there, ready for you to withdraw. In reality, your institution makes money on your money by lending it elsewhere, including to the fossil fuel companies driving climate change, as well as emissions-heavy industries like manufacturing." (wired.com)

In fact, according to Project Drawdown (the leading platform for climate solutions and research):

- "For the average person in the U.S., personal banking may constitute a large source of indirect greenhouse gas emissions

- Every US$1,000 a person has in savings is roughly equivalent to the direct emissions generated by flying from New York to Seattle every year"

- That is a lot: 612 kg CO2 or 0.61 tonne (travelnav.com). The average carbon footprint for a person in the US is around 16 tonnes (nature.org).

- "In fact, if you moved $8,000 dollars—the median balance for US customers—the reduction in your indirect emissions would be twice that of the direct emissions you’d avoid if you switched to a vegetarian diet." (wired.com)

- "Eleven of the largest U.S.-based banks lend around 19.4% on average – and as high as 30% – of their portfolios to carbon-intensive industries

- Moving from a carbon-intensive bank to a climate-responsible bank could reduce the personal banking emissions of an average person in the U.S. by 76%

- Switching banks can be a powerful, relatively easy, and affordable climate action"

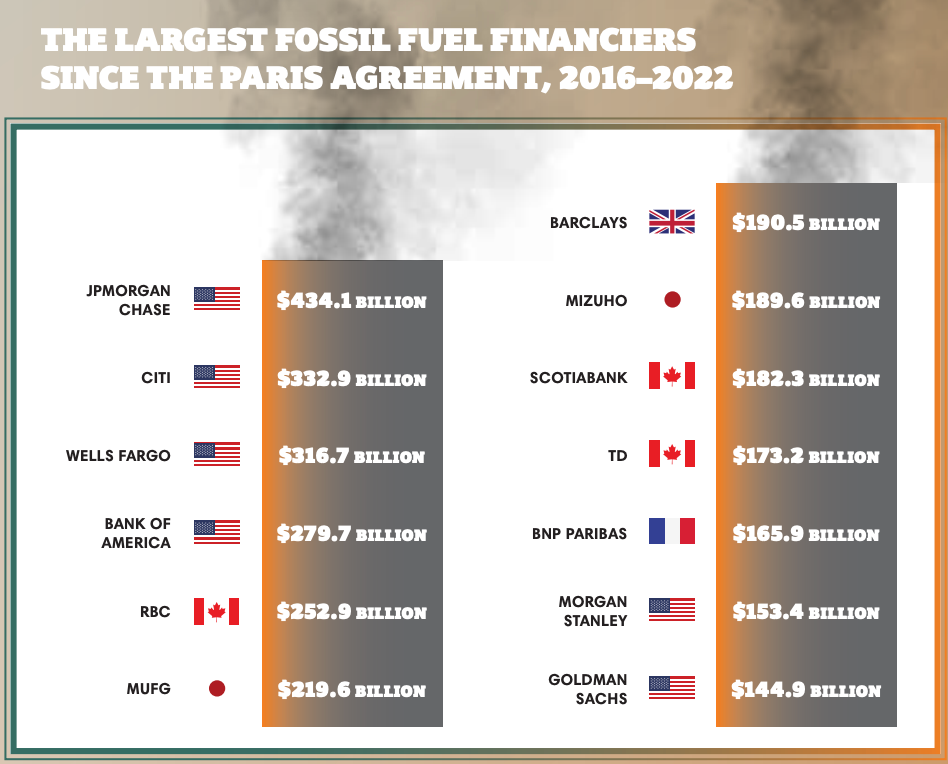

For me, switching to a green bank was the easiest part of greening my finances (which I count as personal banking, investments, credit cards, and loans). It is a climate action that can make a big difference in emissions for most people because the top 4 banks in the US are particularly bad about funding fossil fuels.

So how do you green your bank?

The Checklist

- Make a list of all your current institutions and accounts (saving, checking, credit cards, debit cards, etc.)

- Make a list of all the associated payments that are attached to these accounts

- Direct deposits

- Payments like rent, utility, phone, loans, or credit cards

- Online payment platforms like PayPal or Venmo

- Subscriptions like Spotify, Netflix, Uber, etc

- Other automatic payments like public transportation cards

- Note: I found it helpful to do this over the course of a month, because most important bills will pop up monthly.

- Create a list of criteria for your new bank. Think about what is most important to you. Here are a few things to consider:

- Online vs in person banking (quality of website vs availability of branches)

- ATMs

- Fees (account fees, ATM fees, overdraft fees, etc.)

- Perks (high interest savings account, associated credit cards, sign up bonuses)

- FDIC insured (important)

- Research green banks using a tool like Bank Green

- Choose a green bank (or a couple)

- Open a new account by transferring a small amount to start

- If you're risk averse about personal banking, like I am, maybe wait until your new debit card arrives, and try it out for a month or so. Make sure the app and website work well, and that you can find an ATM thats convenient for you

- Schedule 2-3 hours and switch over direct deposits and any automatic payments and critical bills

- Schedule another 1-2 hrs to switch over online payment platforms and non urgent payments

- If you forget a couple, don't worry too much. It's funny how quickly most them will reach out to you to get your new account details.

- Don't forget public transportation. Nothing like running for a train only to find your card didn't update.

- Close your old account (bonus points if you tell them you're doing it for climate reasons)

- Bask in the glory of your achievement. You did it!

- Spread the righteousness by telling others!

What I did: I have my money in Citibank, Aspiration and Atmos. I have been slowly moving my money out of Citibank for over a year now. This year I plan to fully switch over.

My criteria for green banks are:

- Good online banking support since I don't really do in-person banking.

- No fee ATMs in at least a few convenient spots in my city. I don't tend to carry a lot of cash, but occasionally I'll need to get some.

- International support for debit cards. I mostly use credit cards when traveling, but I need to be able to use a debit card to get cash sometimes.

- An available high interest rate savings account (one of the main reasons I use Atmos).

- I use Discover and Amex for credit cards, unassociated with my bank account, so credit card availability was not a big deal for me.

- FDIC insured

Need more support? Checkout Switch It Green to see the emissions of your current account, find an alternative, and be supported through the process.

Need some inspiration? Check out how Green Banks are financing clean energy and sustainable climate ventures.