Finance

Mindset of Change

Fuego by Bomba Estereo

Alrighty, here we go.

“Where there was nature and earth, life and water, I saw a desert landscape that was unending, resembling some sort of crater, so devoid of reason and light and spirit that the mind could not grasp it on any sort of conscious level and if you came close the mind would reel backward, unable to take it in. It was a vision so clear and real and vital to me that in its purity it was almost abstract. This was what I could understand, this was how I lived my life, what I constructed my movement around, how I dealt with the tangible. This was the geography around which my reality revolved: it did not occur to me, ever, that people were good or that a man was capable of change or that the world could be a better place through one’s own taking pleasure in a feeling or a look or a gesture, of receiving another person’s love or kindness. Nothing was affirmative, the term “generosity of spirit” applied to nothing, was a cliche, was some kind of bad joke. Sex is mathematics. Individuality no longer an issue. What does intelligence signify? Define reason. Desire- meaningless. Intellect is not a cure. Justice is dead. Fear, recrimination, innocence, sympathy, guilt, waste, failure, grief, were things, emotions, that no one really felt anymore. Reflection is useless, the world is senseless. Evil is its only permanence. God is not alive. Love cannot be trusted. Surface, surface, surface, was all that anyone found meaning in…this was civilization as I saw it, colossal and jagged…”

Bret Easton Ellis, American Psycho

Here we are, in the 2020's. Capitalism is the name of the game and the primary method of exchange and value is the almighty dollar. Love it or hate it, all of us participate to some extent in the economy. Money is how you buy groceries or pay your electricity bill. Its also how companies fund new oil wells and fracking projects. In order to find a sustainable way for humans to live on this planet, we need to consider how we lead our financial lives - that is to say, how we handle our money.

For most of us this means looking at two main things:

- Banking. More or less, this is how we store, withdraw, and make payments with the money that we use on a daily, weekly, monthly basis.

- Investments. Generally speaking, this is how we store and accumulate money we intend to use later, often for retirement or to fund large expensive items, like our kids college educations.

Now, I have to explicitly state that I am not a financial advisor and you should certainly consult with one. However, I have gone through the process of trying to green my finances, and I have also studied and participated in impact or double/triple-bottom-line investing. Which means what exactly?

Broadly speaking, the concept of investing is not new. Having been invented in the western world sometime between the 17th and 18th centuries, the idea was relatively simple: in order for companies or entrepreneurs to gather enough money to fund their ideas/expansion, they would solicit investment from people (or other companies or sometimes governments), and in return those people would get a share of the profits when available. In 1602, the Amsterdam Stock Exchange was founded, and it became possible to then buy and sell shares in that future profit (investopedia.com).

The main motivation was, of course, to get a good return on your investment i.e. to make more money. This was explicitly not values-based investing. An early example is the founding of the East India Company in 1600, a British company which subjugated and ran much of India for almost 200 years. The fate of native Indians and rightness didn't factor into it.

In fact, it wasn't until the 1960's that the concept of socially responsible investing arose at all. Until then, the idea that we should not finance things that were bad for society really didn't exist. And 'impact investing' - the idea that we should purposefully finance things we thought were good for society - was only invented by the Rockefeller Foundation in 2007.

By that point, financing had become quite a sophisticated operation. Large bundles of shares are now grouped into funds, curated by savvy mega advisors like Vanguard. On top of that, you might have a money manager, or maybe your job provides a 401k which defaults to investing in Fortune 500 companies or other stable funds. By and large, most people today don't really manage their own investments. Heck, if I asked you what companies you are invested in right now, would you know?

In essence, that means millions of people have their life savings invested in things they may not actually want to finance, including alcohol, cigarettes, guns...or fossil fuels.

ESG Investing

Well, there must be some acceptable alternative right? We've had 50 years since the 60s. Surely there was some improvement in that time? And there was!

ESG investing (short for Environmental, Social, and Governance) is investing that filters out the most widely socially-unacceptable of these, like cigarettes and guns. It also requires some minimal standard for corporate responsibility and employee welfare.

Double or triple bottom line investing - also called impact investing - goes a step further and requires that the return on your investment come back in dollars and social good (double) or dollars, social good, and environmental impact (triple). It is different from ESG in that ESG investing filters out bad companies, where as impact investing is a different methodology of investing that tries to find and fund 'good' companies.

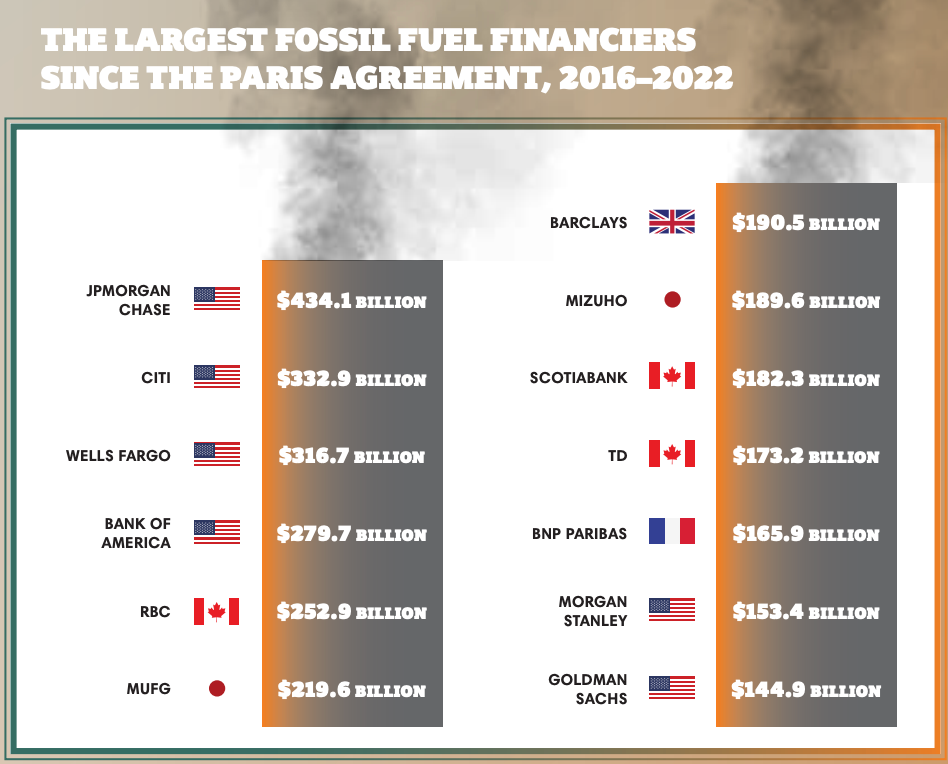

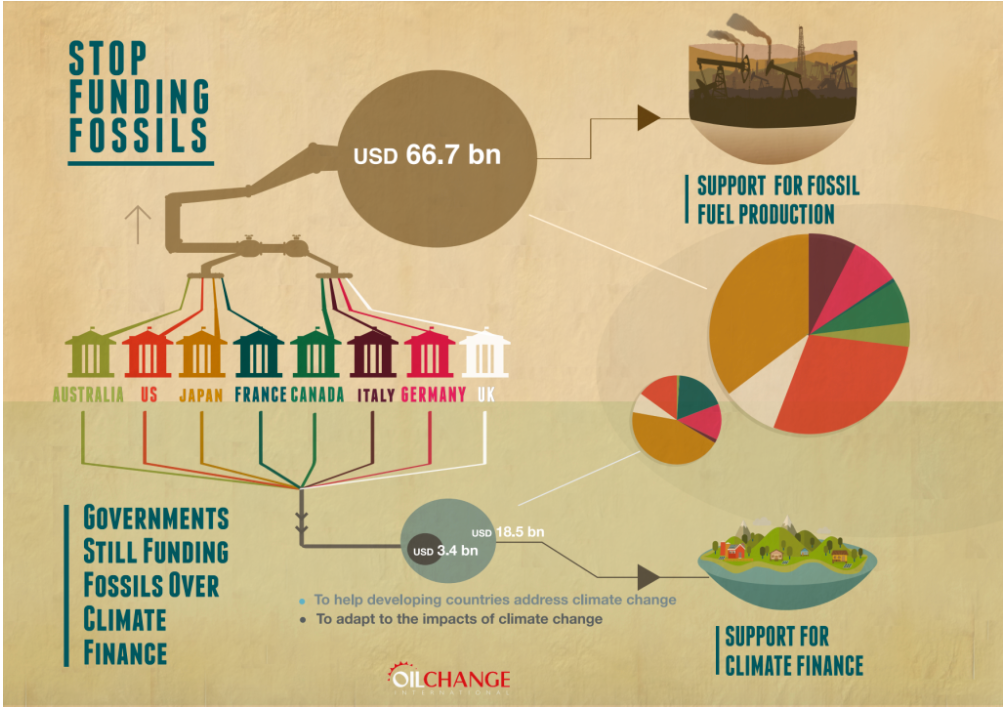

This is important because ESG investing does not typically exclude fossil fuel companies, and ESG is still seen as the progressive standard. For example, Chase bank publishes an annual ESG report, but has also provided $434 billion in financing to fossil fuel companies from 2016-2022 (ran.org). Given the Paris Climate Agreement was signed in 2015, requiring that participating countries (including the US) create carbon emission reduction targets, this is pretty egregious. And Chase is not alone. A number of US-based banks are major financiers of fossil fuel projects.

To say it plainly: When you bank with Chase or Citibank or Wells Fargo, or any other fossil-fuel financing bank, they are likely leveraging your hard-earned dollars to finance fossil fuel extraction. And when you invest in the average index fund, you are probably also investing in fossil fuels.

"It should be added that these four banks are also the top four holders of U.S. domestic deposits, meaning they’re financing fossil fuels with the cash deposits of regular working people who overwhelmingly support action to mitigate climate change." (news.littlesis.org).

Green your finances

Figuring out how to green your bank and investments is no easy feat. It took me probably two years to move over all my investments, including rolling over old 401k's. I am still in the process of transferring my banking and credit cards, because let's face it, finding a reliable green bank can be tricky and moving over payments is a pain in the butt.

My pain is your gain, though, and I'm here to provide you with the research and checklists that I didn't have when I started. Hopefully it will help you feel more comfortable about managing your money in alignment with your values.

It also has to be said: changing your investment profile can be really hard at first. Fossil fuel companies have been having record profits, and it's hard to turn away from what seems like easy money. I find it useful to remind myself that I would rather be a little bit poorer in a rich world, than a tad richer in a world that is dying.

“If you want to succeed you should strike out on new paths, rather than travel the worn paths of accepted success.”

John D. Rockefeller

Fossil fuels need to become the past. There are new technologies and companies that are going to define the future. Investing in them will not only yield a more abundant and sustainable world, but get you in on the ground floor of future market leaders. We need to find these companies and finance them.

Note: I'm working on filling in each one of these. If you want to get the latest content as I write it, please subscribe!

- Banking

- Investments

- Credit cards

- Loans

Feeling disgusted by the state of the world? Don't despair. If we invest in the right solutions, nature will help us out.

Check out this awesome video:

Nature can bounce back super quickly if we help it out.